The USD/JPY forex pair, a important benchmark within the forex current market, is affected by a multitude of economic, geopolitical, and psychological things. Let us delve into the most recent Investigation of the dynamic pair.

Critical Variables Influencing USD/JPY

US Financial Indicators:

Federal Reserve Plan: The Federal Reserve's monetary plan decisions, specially curiosity rate changes, have a major influence on the US Greenback's strength. Greater fascination costs ordinarily fortify the dollar.

Financial Progress: The overall wellness of your US economic climate, including GDP growth, work facts, and shopper investing, plays a vital part. A strong US overall economy can bolster the greenback.

Geopolitical Factors: Worldwide geopolitical occasions, like trade tensions and political instability, can influence the greenback's price.

Japanese Financial Indicators:

Financial institution of Japan (BoJ) Plan: The BoJ's financial coverage, such as its generate curve Management coverage and quantitative easing plans, influences the Yen's price.

Economic Expansion: Japan's economic progress, especially its export-oriented financial state, is delicate to world wide economic situations.

Threat Sentiment: For the duration of times of worldwide uncertainty and hazard aversion, the Yen tends to appreciate as it is considered a secure-haven currency.

Interest Amount Differentials:

The fascination rate differential involving the US and Japan is a significant driver from the USD/JPY pair. A widening interest level differential, Along with the US offering bigger costs, generally strengthens the dollar.

World Chance Sentiment:

World market sentiment and hazard hunger can affect the USD/JPY pair. All through periods of risk aversion, the Yen tends to analysis jen appreciate as buyers request security within the Japanese currency.

Specialized Assessment of USD/JPY

Technological analysis consists of researching previous rate charts and designs to forecast long run selling price actions. Important technical indicators and chart designs to watch for in USD/JPY involve:

Relocating Averages: These indicators might help discover tendencies and prospective support and resistance stages.

Relative Energy Index (RSI): This oscillator measures the velocity and alter of rate actions to detect overbought or oversold situations.

Moving Average Convergence Divergence (MACD):: This indicator assists establish development variations and prospective turning points.

Help and Resistance Degrees: These are typically selling price degrees wherever the forex pair has Traditionally struggled to move beyond.

Chart Patterns: Recognizable patterns like head and shoulders, double tops/bottoms, and triangles can offer insights into prospective long term price tag movements.

Conclusion

The USD/JPY forex pair is a complex instrument affected by a multitude of things. By carefully analyzing economic indicators, financial coverage selections, geopolitical situations, and technical charts, traders will make educated decisions. Nevertheless, It is necessary to do not forget that the forex industry is highly volatile, and previous overall performance is not indicative of future benefits. Chance management procedures, such as halt-reduction and choose-profit orders, should constantly be utilized to safeguard funds.

Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Ross Bagley Then & Now!

Ross Bagley Then & Now! Hailie Jade Scott Mathers Then & Now!

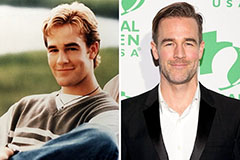

Hailie Jade Scott Mathers Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now!